The development of the first-grade copper sulphide ore Wash-hi mine is progressing well with the stripping of overburden and oxide/gossan ore continuing in Wash-hi pit, at a current depth of 25 meters below surface.

Key Highlights

- Development of Wash-hi mine progressing well with stripping of overburden and oxide/gossan ore continuing in Wash-hi pit, at a current depth of 25 meters below surface.

- High-grade copper sulphide ore exposed at 430 SRL in the pit.

- LME spot copper returns to above USD 9000 per tonne, increasing the net present value (NPV) of Alara’s interest in the project to USD 61.71 million (AUD 88.24 million)1.

Alara Resources Limited (ASX:AUQ) (Alara or the Company), a base and precious metals explorer and developer with projects in Oman, informed investors of encountering high-grade copper sulphide ore at the Wash-hi mine (Al Wash-hi Majaza CopperGold Project or the Project) in the Sultanate of Oman.

Alara owns a 51% equity interest in Al Hadeetha Resources LLC (AHRL) the joint venture (JV) developing the Project.

Blast Hole drill sample results

Samples from blast holes between 433 SRL and 427 SRL analysed at an onsite laboratory indicated the presence of high-grade copper sulphide ore at shallow levels in the pit.

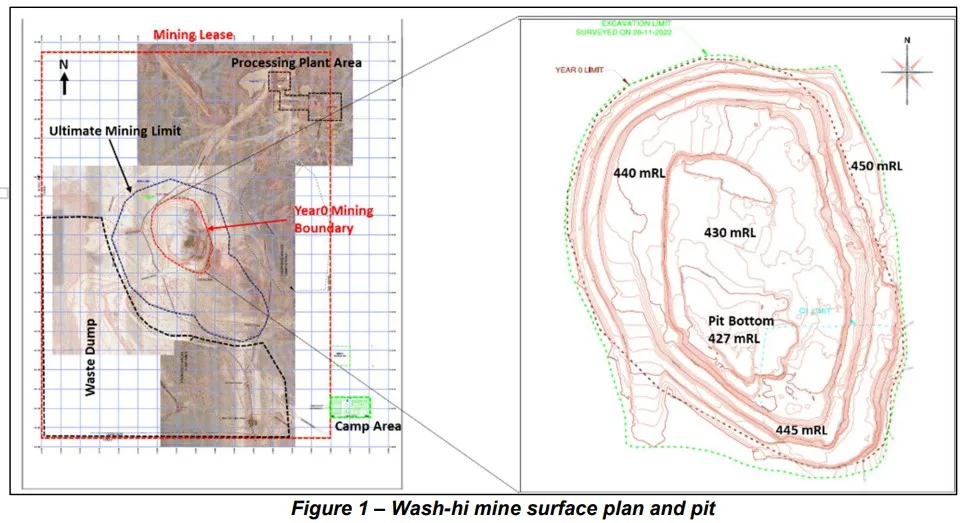

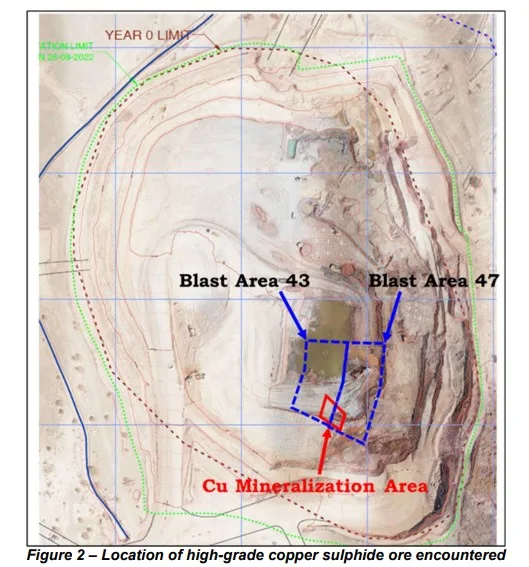

Figures 1 and 2 below show the surface plan of the mine, current extent of the pit, and the location of the first copper sulphide ore encountered at the mine. Tables 1 and 2 show the results of testing samples from the onsite laborator.

Face samples were also collected after blasting and analysed at the site lab. The analysis results are given in the table below.

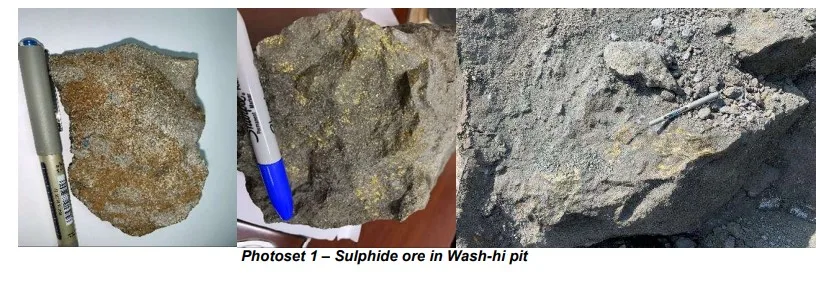

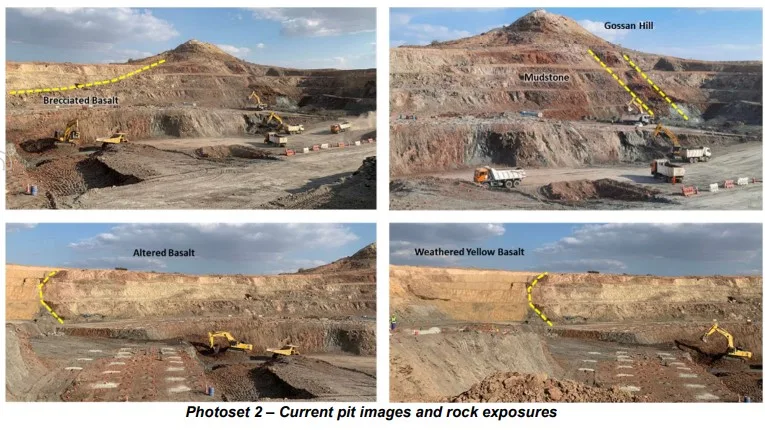

The photo sets below show the ore samples after blast and pit geology.

- Host rock: mineralized basalt

- Observed sulphide minerals: pyrite, chalcopyrite and (+/-) bornite

- Mineralisation appears to be disseminated type fracture filled to semi massive in nature, chalcopyrite-rich, high-grade vein within pyrite-rich basalt.

Copper price rebound

On 11 January 2023 the LME spot copper price broke back above USD 9000 per tonne, a level not seen since June 2022, and reached USD 9185.50 on 16 January.

This indicates the market may be shaking off inflation fears, returning the price of the metal to levels more consistent with projected medium to long-term high demand as the world’s energy system moves towards renewables.

The latest update to the Project financial model completed in 2021 showed that the Project has a net present value (NPV) of USD 121 million at a copper price of USD 9000 per tonne. Alara’s 51% share of Project NPV is USD 61.71 million (AUD 88.24 million).

Alara Managing Director, Atmavireshwar Sthapak said: “We are delighted with the progress already made in the development of Wash-hi mine pit and pleased with high grade copper ore now being excavated in the mine. ”

We look forward to providing further updates on construction activities at the Al Wash-hi Majaza Copper-Gold Project over coming months.” Sthapak

Al Hadeetha Resources LLC is the first international joint venture company that has been awarded a copper mining licence in Oman in 2018 for the Wash-hi Majaza project.

Located in North Al Sharqiyah Governorate, the Wash-hi Majaza copper-gold deposit has been evaluated under JORC standards for over 16 million tonnes of copper resources and 10 million tonnes of mineable reserves.

With an increase in global demand for copper, the Wash-hi Majaza project provides various channels of growth and prosperity in the economy as well as socioeconomical benefits to the Sultanate of Oman and local communities such as providing employment for approximately 200 Omanis, local skill developments, opportunities for local suppliers and vendors, infrastructure development and more.