Bitcoin Guide | Since its spectacular climb in 2017, Bitcoin has become the most talked-about topic in the Crypto world! If you think that’s incredible, wait till you hear what’s next!!

Bitcoin has already been making news for quite some time now. It has evolved into an entity capable of producing multi-bagger returns. Despite this, many industry leaders have expressed a variety of views on Bitcoin.

Some people are convinced that Bitcoin and Other currencies like Ethereum, Cardano, Matic, Btt are the way of the future for free-flowing economies. However, other people are opposed to the concept, seeing it as a digital entity with dubious and ambiguous value.

Despite being one of the most often discussed issues, it remains a mystery to many.

Let’s have a look at how we can mine our way into the realm of bitcoin.

What does Bitcoin stand for and what does it represent?

Bitcoin, like the dollar, euro, yen, pound sterling, and rupee, is a currency. The only similarity between conventional banking and Bitcoin is that they are both digital currencies.

Bitcoin is a type of electronic money. However, despite the currencies, you’re used to, it’s not governed by a reserve bank. Instead, Bitcoin’s financial system is managed by hundreds of computers all around the globe. Installing open-end software allows everyone to participate throughout the ecosystem.

It allows users to receive and send electronic currency. Its allure stems from the fact that it cannot be filtered, cash cannot be used multiple times, and payment transactions may be completed at any time and from any location.

Traditional currencies are issued and managed by a centrally authorized bank under the jurisdiction of the individual nations. Fiat currencies, also known as centralized currencies, are issued and managed by central banks.

Let’s look at cryptography in more detail. Cryptography is the practice of encrypted transmission that employs algorithms to convert data into unreadable code which can only be decoded/decrypted by authorized senders/receivers.

Bitcoin is peer-to-peer digital money that functions without a central authority. It’s computer software with a value that’s been encrypted with a strong crypto-algorithm to ensure its authenticity.

Bitcoin can be used to pay for goods or services if the service provider accepts it, much like traditional currency, but in a digital format akin to SMS.

Why was Bitcoin Developed and how did it Come to Be?

A whitepaper titled Bitcoin- A Peer-to-Peer Electronic Money System was produced in 2008 by a person or group of persons using the alias SATOSHI NAKAMOTO.

Satoshi Nakamoto began mining Bitcoins once the code was published as open-source on January 9, 2009.

Satoshi, who worked on Bitcoin until December 2010, is the creator of the cryptocurrency. That’s pretty much all of the publicly available information on Nakamoto.

It’s essential to understand why bitcoin was created now that we know who invented it.

The goal behind the decentralised currency was to establish an ecosystem that would run parallel to the centralised economy, which is governed by government rules and requires citizens to trust the banking system to maintain the currency’s value. The currency was managed entirely at the government’s disposal.

The financial crisis of 2008, for example, was created by faulty loans given by banks, as well as the banks accused of causing the crisis were bailed out with taxpayer money or the public exchequer as a result.

Despite being the accused, revenue generated from the general public was used to save banks. This demonstrates the administration’s discretionary powers. Many ordinary individuals lost their life savings and employment, leading to severe economic downturns.

What is the value of Bitcoin?

Bitcoin is a decentralised, censorship-proof, borderless and safe digital currency.

This feature has created it interesting for used cases like remittances from abroad and payments when people don’t want to divulge their names.

Many people choose to hold on to their bitcoins rather than use them. Due to the limited circulation of tokens accessible, Bitcoins are dubbed “digital gold.” Bitcoin is seen as a place for value by some investors. It’s been compared to valuable metals such as gold and silver due to their scarcity and difficulty in production.

Holders think that these characteristics, together with its High stability and global affordability, make it a perfect medium for long-term wealth storage. They feel that the value of Bitcoin will rise in the future.

What is Bitcoin’s Mechanism?

Bitcoin is digital money that requires a ledger platform to track its transactions. Bitcoins make use of Blockchain, which is yet another ground-breaking ledger technology.

Let me give you a little primer on blockchain technology before continuing.

Blockchain, also known as Distributed Ledger Technology, is the foundation of Bitcoin, as it keeps track of all transactions. Because this is an open-source and public ledger, anyone may check the transactions. This method also does away with the necessity for third-party validation, as well as the trust-based transactions traditional currency financial institutions rely on.

In Bitcoin, there are a few key phrases to understand. A wallet, a public key, and a secret key are all required?

The public key is the address for depositing and withdrawing transactions. Similar to a username on a social network newsfeed, this key symbolises the holders’ digital signature on the ledger of blockchain. The private key is the passcode that allows you to purchase, sell, and exchange bitcoin in your wallet.

A private key should be kept confidential and used exclusively to authorise Bitcoin transactions. Some users safeguard their private keys by encrypting their wallets with secure encryption and, in some situations, opting for cold storage, which stores the wallet offline.

Consider the instance of a peer-to-peer Bitcoins exchange.

Jerry was willing to sell John bitcoin. He’ll need to download and install a Bitcoin Wallet programme on his computer, which will have a public key that will serve as John’s bitcoin address.

Jerry, who wants to sell bitcoins for US dollars, can now receive John’s public key by email. Jerry will authorise the transaction with his private key, which is addressed to John’s public address, once John transfers money to Jerry’s bank account.

Blockchain is used to complete this transaction. The transaction is validated by comparing it to the bulk of transaction pattern records stored in the blockchain’s databases.

The payment is only securely recorded on the Blockchain network after this process is done. As a result, John was compensated. John can now use his private key to gain access to the bitcoin in his wallets.

A cryptocurrency wallet is a program for storing digital money. There are several distinct types of wallets, such as hot and cold wallets, that are utilized on various platforms, such as mobile and desktop.

What is the Process of Bitcoin Creation?

Bitcoin is created through a process known as cryptocurrency mining. Mining is the process of verifying transactions to earn rewards by forming a Block using a large amount of computational power.

Blocks hold information based on operations, a Nonce(64-bit), and the previous block’s Hash number(256-bit). It’s important to note that you’ll need a lot of electricity and the ability to sustain your computer Rigs, which are referred to as Mining Rigs.

Only when the freshly created block contains Proof-of-Work is transactional verification permitted. The process of locating a unique number known as Nonce is known as POW.

You won’t have to conduct any manual arithmetic or calculations. All you need is a competent electronic gadget and the programme that the developers recommend. Those operations will be handled by your device’s CPU or GPU. In some circumstances, keeping electronic devices linked to the internet may be required.

How can you convert bitcoin to fiat or other cryptocurrencies?

If there is enough market fluidity, one can purchase or sell Bitcoin based on its market value at a certain time interval. It’s akin to stock market trading, but it’s a process that runs 24 hours a day, seven days a week.

Bitcoin isn’t as stable as equities and isn’t backed by any actual assets or commodities. You don’t get any physical goods; instead, you get the addresses of the digital content you bought, which you can store in your crypto wallets.

Alibaba, Coinbase, and Pionex are examples of dedicated platforms for this purpose. However, before trading on any of these sites, double-check the processing fees.

What exactly is a blockchain?

The blockchain is an append-only ledger, which means that data may only be updated to it. It’s exceedingly tough to change or remove information once it’s been entered. Every successive block in the blockchain includes a reference to the preceding block, enforcing this.

The previous block’s hash is used as the reference. Passing data via a one-side function produces a signature of the inputs that is unique, which is known as hashing.

The fingerprints will look radically different if the input is changed even little. There’s really no alternative for anyone to modify a previous entry without deleting the blocks after it because the blocks are chained together. One of the aspects that make the blockchain protective is a structure like this.

Is Bitcoin a legal currency?

In most nations, Bitcoin is totally legal. However, there seem to be a few exceptions; before enrolling in cryptocurrencies, make sure you understand the regulations in your area.

When it comes to compliance and taxation, government agencies in nations where it is lawful adopt a variety of tactics. Overall, The regulatory regime is still undeveloped, and it will most likely evolve dramatically in the future years.

Bitcoin’s Background

Who is the inventor of Bitcoin?

Nobody is aware of it! The creator of Bitcoin went by the pseudonym Satoshi Nakamoto, but we don’t know who he or she is. Satoshi could be a single developer or a group of devs located anywhere on the planet. Satoshi’s name is Japanese, but his command of the English language has caused many to believe he/she/they are from an English-speaking country.

The Bitcoin white paper and software were both published by Satoshi Nakamoto. However, in 2010, the enigmatic creator vanished.

Is it true that Satoshi Nakamoto invented the blockchain?

Bitcoin is a hybrid of several existing technologies that have been around for some time. Bitcoin didn’t invent the concept of a block in the chain. When Stuart Haber and W. Scott Stornetta devised a system for timestamping papers in the early 1990s, they used unalterable data structures like this. It used cryptographic techniques to safeguard the security and reduce from being tampered with, similar to the blockchains of today.

Surprisingly, Satoshi’s white paper never uses the phrase “blockchain.”

Please find below a copy of the original whitepaper

Why is Bitcoin so popular?

Unlike other currencies, there is also a limited amount of bitcoin in the world, 21 million to be exact, and there are approximately two million bitcoins left to mine.

There seems to be this complete hoax about his origins as well. Who is this mysterious Satoshi Nakamoto? Can it be more than one person? Will we ever know who it is?

It’s also key to recognize that Bitcoin’s popularity is fueled directly by its social media reach.

“Bitcoin and other cryptocurrencies are completely dynamic,” said Stevenson AltFi, “This is a classic example of a free market economy of supply and demand.”

“Most people are just having a good time, there is a certain level of gamification to it, and there is nothing wrong with that.”

We also need to remember that few people outside of The Crypto Cult treat it as highly as those in the Crypto Echo Chamber, which in turn drives its popularity.

Buying Bitcoin

f you’re wondering how to purchase bitcoins, this buyer’s guide should help you get started. Investing in digital currency like bitcoins is risky business, but it’s also lucrative if you know what you’re doing. Buying digital currency is easy, provided that you don’t mind some risk. But, for some people, there are better ways to invest money than traditional investment vehicles such as bonds, stocks, and funds. The easiest way to do this is through the purchase of bitcoins.

There are a lot of different ways that people have started buying bitcoins. Some of them include: using a broker/exchange who offers services such as buying, selling, and trading coins; accepting trades made by third parties; and accepting purchases and exchanges made by you.

All of these options have their pros and cons. With one, there is the risk of exchange error or even charges on your end when you make an incorrect purchase or transaction. On the other hand, with all of the options mentioned above, there is also the possibility of losing some of your hard-earned profits on ether, gold, or silver when you accept outside trades.

Selling Bitcoin

Selling bitcoin ( bitcoins) is like buying Bitcoin, except in an almost reverse fashion. To sell one or more Bitcoins, you first need to have adequate bitcoins on hand in your private wallet. Buying Bitcoins is also possible through various routes, including an on-line currency exchange, through a variety of offline venues, and even by contacting an agent who will buy the coins for you. Many people who want to buy or sell bitcoins do so online. If you want to do this, it’s important to understand how the process works.

Many of these on-line and offline exchanges will only work with highly regulated and accredited exchanges. Some Cryptocurrency Exchanges are simply not licensed to handle or trade in currencies, while others are licensed but not regulated. In order to be sure that you’re working with a regulated dealer, it’s best to read all applicable documentation surrounding the currency being exchanged. The best method for doing this is by going to the regulatory website of the Cryptocurrency Exchanges.

Mining your own bitcoin

By now I know you’ve either heard about or are familiar with the concept of Mining your own bitcoin. It’s a fun and easy way to get started as an investor in the digital currency market

If you have heard about it and interested in trying it out yourself, here is a brief guide on how to go about it. Just like trading any other stocks, shares or commodities – you want to find a good, secure place to hold your shares. This will make for a more profitable investment portfolio overall.

The process

Mining is the process of creating valid blocks that add transaction records to the public Bitcoin ledger (BTC), known as the blockchain. It is a key component of the Bitcoin network as it solves the so-called “double-spending problem”

The problem of double-spending relates to the need to find a consensus on the history of transactions. Bitcoin’s ownership can be proved mathematically through public key cryptography, which cannot be broken with today’s technology. However, cryptography alone cannot guarantee that one particular coin has not previously been sent to someone else. To create a common transaction history, you must have an agreed order, which is based, for example, on the time of creation of each transaction. But any external contribution can be manipulated by whoever provides it, requiring participants to trust that third party.

Mining uses economic incentives to provide a reliable and uncertain way to order data. Third parties ordering trades are decentralized and receive cash rewards for correct behaviour. On the contrary, any inappropriate behaviour causes a loss of economic resources, at least as long as the majority remain honest.

For bitcoin mining, this result is achieved by creating a series of blocks that can be mathematically proven to be arranged in the correct order with a specific resource commitment. The process relies on the mathematical properties of a cryptographic hash – a way to encode data in a standardized way.

Hash is a one-way encryption tool, meaning it is nearly impossible to decrypt them to your input data unless every possible combination is tested until the result matches the given hash.

This is what bitcoin miners do: They cycle through trillions of hashes every second until they find one that satisfies a condition called “difficulty.” Both complexity and hash are very large numbers expressed in bits, so the condition simply requires the hash to be below complexity.

The difficulty is adjusted every 2016 bitcoin blocks – or roughly two weeks – to maintain a constant block time, which refers to how long it takes to find each new block while mining.

The hash generated by miners is used as an identifier for any particular block and consists of the data found in the block header. The most important components of the hash are the Merkle root – another aggregated hash that encapsulates the signatures of all transactions in that block – and the unique hash of the previous block.

This means that changing even the tiniest component of a block will noticeably change its expected hash – and so will the hash of every subsequent block. The nodes will instantly reject this wrong version of the blockchain, protecting the network from hacking.

Through the requirement of difficulty, the system ensures that Bitcoin miners do real work: the time and electricity spent in hashing through the possible combinations. This is why Bitcoin’s consensus protocol is called “proof of work,” to distinguish it from other types of block-making mechanisms. To attack the network, malicious entities have no other method than to recreate the entire mining power. For Bitcoin, this would cost billions of dollars.

How Bitcoin miners are paid

The network recognizes the work of the Bitcoin miners in the form of rewards for generating new blocks. There are two types of rewards: new bitcoins created with each block and fees paid by users for transactions on the network. The block reward of newly minted bitcoin, which amounts to 6.25 BTC as of May 2020, makes up the bulk of the miners’ income. This value is programmed in such a way that it halves at fixed intervals of around four years, so that at some point no more Bitcoin will be mined and only transaction fees guarantee the security of the network.

By 2040, the block reward will have shrunk to less than 0.2 BTC and only 80,000 Bitcoin from 21 million will be left to be earned. Only after 2140 will mining effectively end, as the final BTC will be slowly extracted.

How to choose hardware for mining

The first thing to keep in mind is that for mining Bitcoin you can only buy an application specific integrated circuit, commonly known as an ASIC.

These devices can only mine Bitcoin, but they are very efficient. In fact, they’re so efficient that their introduction around 2013 made all other types of mining computing devices obsolete almost overnight.

If you want to mine with popular CPUs, GPUs, or more advanced FPGAs, you have to look at other coins. Although these devices can mine Bitcoin, they do it so slowly that it is just a waste of time and electricity.

For reference, the best graphics card available just before the advent of ASICs, the AMD 7970, was producing 800 million hashes per second. The average ASIC today produces 100 trillion hashes per second – a 125,000 times difference.

The number of hashes produced in one second is commonly referred to as the “hash rate” and is an important performance measure for mining devices.

There are two other main factors that should be considered when buying a Bitcoin mining device. One is electricity consumption, measured in watts. Between two devices that produce the same number of hashes, the one that uses less electricity will be more profitable.

The third measure is the unit cost for each device. It makes no sense to have the most energy efficient ASIC in the world if it takes 10 years to pay off from mining.

Bitcoin has a pretty vibrant ecosystem of ASIC producers that often differ in these three dimensions. Some may produce more efficient but also more expensive ASICs, while others produce less efficient hardware that sells for a lower price. Before analyzing which device is best for your needs, it is important to understand other factors that affect the profitability of Bitcoin mining.

Buying and setting up the hardware

There are several stores that sell ASICs to retail customers, while some manufacturers also allow direct purchases. Although they are harder to find than common graphics cards, it is still possible for anyone to purchase an ASIC at an acceptable price. It should be noted that purchasing mining equipment from stores or manufacturers shipping from foreign countries may result in high import duties.

Depending on the manufacturer or store, ASICs may be offered without a power supply unit, which will then need to be purchased separately. Some ASIC manufacturers sell their own units, but it is also possible to use power supplies designed for servers or gaming computers, although they probably require special modifications.

ASICs must be connected to the Internet via an Ethernet cable and can only be configured through a web browser by connecting to the local IP address, such as a home router.

Before continuing, it is necessary to create an account with a mining pool of your choice, which will then provide detailed information on how to connect to its servers. From the ASIC web panel, you need to insert the pool connection endpoints and account information. The miner will then start working and generating Bitcoin.

Mining through an established pool is highly recommended, as you will be able to generate consistent returns by pooling your material with others. While your device may not always find the correct hash to create a block, your mining contribution will always be rewarded.

Risks and considerations for Bitcoin mining

In addition to the financial risks of not making a profit, there are technical risks involved in managing high-power devices such as ASICs.

Adequate ventilation is essential to avoid overheating of mining equipment components. All a miner’s electricity consumption is dissipated into his environment as heat, and one ASIC will likely be the most powerful device in your home or office.

It also means that you must carefully consider the limitations of your electricity network when mining bitcoin. Your home’s electrical network is rated at its maximum power level, and each outlet also has its own rating. Exceeding these limits can easily cause frequent power outages or electric fires. Consult an expert to determine if your electrical system is safe for mining.

Regular maintenance against dust and other environmental influences is also required to keep the mining equipment healthy. Although failures are relatively rare, ASICs can be taken out of service earlier than expected without proper maintenance.

While individual ASICs can fail, the greatest threat to their profitability is that they become obsolete. More efficient miners will eventually displace older equipment.

Historic generations of miners like the Bitmain S9 released around 2016 took about four years before becoming unprofitable under any electricity price configuration (other than zero). However, the pace of advances in computer technology is largely unpredictable.

Bitcoin mining is no exception to any other company. There is potential for rewards, but there is also risk. Hopefully this guide provided a decent starting point from which to further evaluate both.

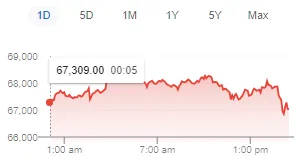

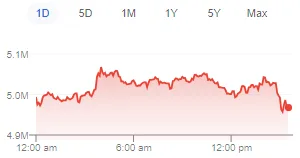

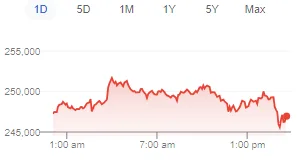

Price of 1 Bitcoin as of 9 Nov, 3:21 pm UTC

91,214.50 Australian Dollar

67,035.00 United States Dollar

4,968,503.48 Indian Rupee

246,269.69 United Arab Emirates Dirham

94,476.95 New Zealand Dollar

Now you’ve read this artcile you will have a much better understanding of Bitcoin and what you need to know.