Picture a bustling neighborhood where gadgets and devices are like friendly neighbors, chatting and helping each other out. This neighborhood is called the Internet of Things (IoT), and it’s growing fast

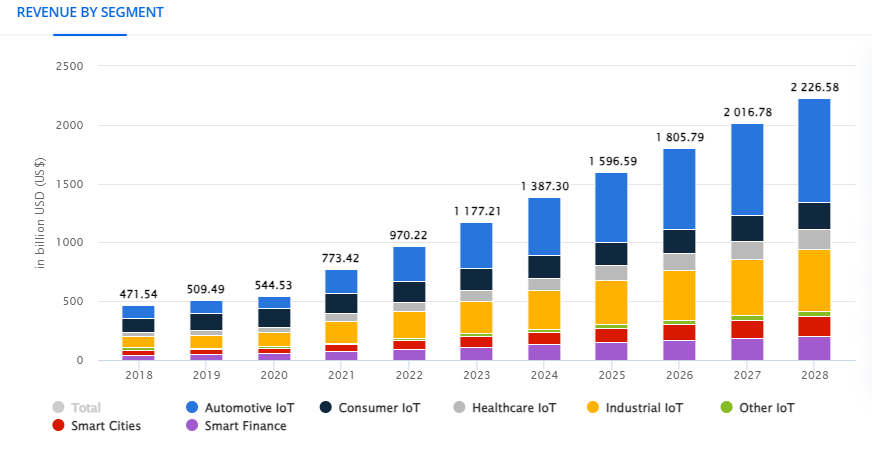

By 2024, experts say it will be worth a mind-boggling $1,387.00 billion worldwide. And the coolest spot in this neighborhood? It’s the Automotive IoT corner, where cars and trucks are the stars, with a whopping market value of $494.20 billion.

Overall, “Fortune Business Insights” predicts the IoT market is projected to grow from $662.21 billion in 2023 to $3352.97 billion by 2030, at a CAGR of 26.1%

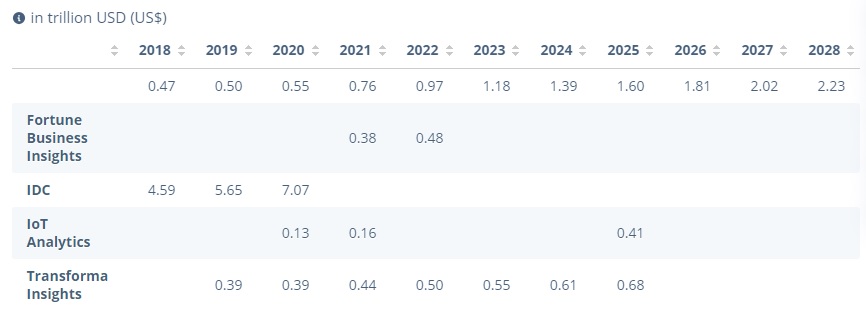

These forecasts, outlined in a comprehensive report on the state of the IoT industry, highlight the transformative impact of connected technology across various sectors.

From smart cars to industrial automation, IoT-enabled devices are reshaping traditional business models and driving innovation on a global scale.

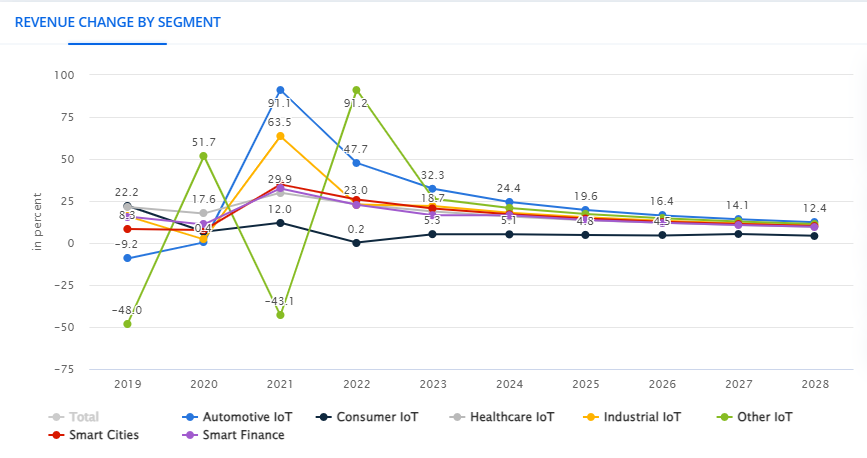

Looking beyond 2024, experts anticipate a continued upward trajectory for the IoT market, with an impressive annual growth rate of 12.57% projected from 2024 to 2028.

By the end of this period, the market volume is forecasted to reach an unprecedented US$2,227.00 billion, underscoring the immense potential of IoT technology in the years to come.

Most recent update: Sep 2023

A closer examination of regional trends reveals the United States as a frontrunner in the global IoT landscape, poised to lead the pack with an expected revenue of US$199.00 billion in 2024. This significant market share underscores the country’s strong foothold and influence in driving IoT adoption and innovation.

Most recent update: Sep 2023

Within the United States, the IoT market is experiencing rapid expansion, fueled by substantial investments in smart home devices and connected cars by leading companies.

From smart thermostats to autonomous vehicles, consumers and businesses alike are embracing IoT solutions to enhance efficiency, improve decision-making, and unlock new opportunities for growth.

- Comparable Estimates

Analyst Opinion

The advent of Industry 4.0 is propelled by the Internet of Things (IoT), a technology experiencing a remarkable compound annual growth rate (CAGR) exceeding 16% from 2018 to 2028.

Despite the global semiconductor shortage dampening market growth compared to pre-pandemic levels, the demand for intelligent solutions across industrial and security sectors continues to surge.

With a revenue surpassing US$141 billion in 2022, the United States leads the IoT market, closely followed by China, renowned for its IoT device manufacturing prowess.

This growth in the IoT market coincides with advancements in complementary technologies like 5G and cloud computing. The rollout of 5G communication standards facilitates faster and seamless connectivity among IoT devices.

Furthermore, cybersecurity emerges as a formidable challenge, impacting individuals and businesses alike. With the proliferation of data exchange and storage in cloud environments, safeguarding data integrity and ensuring privacy becomes more crucial than ever.

How The Market Size Is Determined

Market size determination involves employing both top-down and bottom-up methodologies. This entails analyzing the annual financial reports of leading market players, industry associations, and third-party research reports.

Additionally, segment sizing for individual countries is assessed using pertinent market indicators and data from country-specific industry associations.

Factors considered include consumer spending, internet penetration, 4G coverage, and current and historical market trends. By leveraging this data, we can accurately estimate the market size for each country.

Security & Privacy in IoT – 2024

As the number of connected devices on your network increases, so does the potential entry points for attackers. With the rise of AI-driven cyber threats anticipated to be a significant concern in 2024, the importance of securing devices, especially in an era of remote and dispersed work setups, becomes paramount.

In the digital and AI-centric landscape, businesses must prioritise maintaining the trust of both customers and employees, emphasising the necessity of prioritising security and privacy when deploying networks of smart devices and interconnected technology.

Global IoT Spending Statistics

- IoT expenditure exceeded $1 trillion in 2023.

- Since 2018, global IoT spending has consistently risen annually by at least $40 billion.

- IoT spending amounted to $749 billion in 2020, and it was forecasted to reach $1 trillion in 2022.

- Predicted IoT spending for 2023 escalated to $1.1 trillion, maintaining the upward trend in year-over-year growth.

Consumer spending figures for smart home products between 2015 and 2025:

| Year | Consumer Smart Home Spending | Change Over Previous Year |

| 2015 | $51 billion | – |

| 2016 | $61 billion | ↑ 19.61% |

| 2017 | $74 billion | ↑ 21.31% |

| 2018 | $83 billion | ↑ 12.16% |

| 2019 | $95 billion | ↑ 14.46% |

| 2020 | $86 billion | ↓ 9.47% |

| 2021 | $123 billion* | ↑ 43.02%* |

| 2022 | $134 billion* | ↑ 8.94%* |

| 2023 | $147 billion* | ↑ 9.70%* |

| 2024 | $159 billion* | ↑ 8.16%* |

| 2025 | $173 billion* | ↑ 8.81%* |

The Automotive Sector (IoT)

From a market perspective, the Automotive IoT corner has witnessed explosive growth, with a staggering market value of $494.20 billion and a promising outlook for further expansion in 2024.

As automotive manufacturers continue to integrate IoT capabilities into their product offerings and consumers increasingly demand connected and intelligent vehicles, the Automotive IoT corner is poised to remain a pivotal force shaping the future of mobility.

The global revenue of the Automotive IoT Market was approximated at USD 131.2 billion in 2023, with a projected rise to USD 322.0 billion by 2028, showcasing a compound annual growth rate (CAGR) of 19.7% during the period from 2023 to 2028.

The expansion is attributed to the surge in regulatory requirements for advanced vehicle features aimed at improving user experience, safety, and convenience. Additionally, the increasing adoption of telematics and user-based insurance programs plays a significant role in propelling the growth of the automotive IoT market share.

The automotive sector, in particular, is also witnessing a paradigm shift with the integration of IoT technology. From connected vehicles to autonomous driving systems, automotive IoT is revolutionising the way we commute, interact with our vehicles, and envision the future of transportation.

- Automotive IoT Market Dynamics

Alternative technologies for powering engines that don’t rely on petroleum, like electric vehicles (EVs), hybrid electric vehicles (HEVs), and solar-powered vehicles, are becoming the primary choice in the automotive industry.

The increasing adoption of EVs and HEVs offers numerous benefits such as reduced fuel costs, minimized air pollution by lowering greenhouse gas emissions, enhanced air quality in urban areas, and decreased dependence on fossil fuels.

Environmental concerns and the imperative to conserve energy have been pivotal in driving the development of HEVs and EVs. Hybrid vehicles are equipped with both an engine and a motor powered by a high-voltage, high-power battery, meeting the demand for increased power efficiency.

The stringent emission regulations globally have led to significant technological advancements in the automotive sector aimed at reducing harmful exhaust emissions.

The emergence of EVs also represents a crucial milestone in environmental protection within the automotive industry, as these vehicles operate without conventional fuel, thereby eliminating the production of harmful gases. These factors have spurred a heightened demand for electric cars, particularly in developed regions like North America and Europe.

- Automotive IoT market in Asia Pacific estimated to grow at the fastest rate

The automotive IoT market in Asia Pacific is projected to experience the highest Compound Annual Growth Rate (CAGR). Major contributors to this market in the region include China, Japan, South Korea, and India.

China, being the largest automobile market, presents significant opportunities for automotive IoT. The growth of the market in Asia Pacific is driven by shifting government regulations favoring the adoption of Advanced Driver Assistance Systems (ADAS) and connected services.

Several factors contribute to the growth of automotive IoT in Asia Pacific, including the widespread adoption of IoT in vehicles due to their intelligent functionalities like fleet management and enhanced monitoring of fuel consumption and travel duration.

Additionally, the increasing production of IoT-enabled automotive in the region further fuels market expansion. Government initiatives aimed at gathering traffic data for effective vehicle monitoring also play a beneficial role in fostering the adoption of automotive IoT technology in Asia Pacific.

- Top Automotive IoT Companies. (Major Vendors)

- NXP Semiconductors (Netherlands)

- Harman (US)

- Robert Bosch (Germany)

- Thales (France)

- TomTom International (Netherlands)

- IBM (US)

- Geotab Inc. (Canada)

- Texas Instruments (US)

- Intel Corp. (US)

- Eurotech (Italy)

- STMicroelectronics (Switzerland)

- Renesas (Japan)

- Infineon Technologies (Germany)

- Emerging Companies in the Automotive IoT Market:

- Airbiquity (US)

- Qualcomm (US)

- Visteon (US)

- Vodafone Group (UK)

- Microsoft Corporation (US)

- Alphabet Inc. (US)

- AT&T (US)

- Cloudmade (UK)

- Sierra Wireless (Canada)

Industry experts attribute the rapid growth of the IoT market to several key factors, including advancements in sensor technology, the proliferation of high-speed connectivity, and the increasing demand for data-driven insights across various industries. .