In a world dominated by the relentless march of technology, we have all felt the dizzying pace of change. But what if we told you that your cherished gadgets are not just evolving – they’re depreciating at a mind-boggling rate, faster than you ever imagined?

Current Spending – 2023

Consumers are spending more but at a slower rate than before. In June 2023, growth was 5% year over year, versus 9% in June 2022. But here’s the twist: Consumer expenditure is slowing down not because people are buying less but because they are paying less for what they buy.

Technology moves fast, whether it’s a shiny smartphone or a top-of-the-line headset. It seems that as soon as you’ve acquired a new gadget, the next must-have model hits the market.

Resisting the allure of new technology can be challenging; indeed, one in ten Americans upgrades their cellphone every year. However, amid a cost-of-living crisis, many consumers are choosing to save money by purchasing second-hand tech in the resale market.

It’s a thriving business: In 2022, 282 million used and refurbished smartphones were shipped globally, a figure expected to reach 415 million in 2026.

These older and used gadgets are more affordable to buy because they have depreciated in value over time, much like a new car losing value as soon as it leaves the lot. A smartphone, for instance, loses around 42.7% of its value within a year of launch—significantly more than a new car.

What Is Tech Depreciation?

Tech depreciation, a phenomenon where the value of technology assets diminishes over time due to rapid advancements and changes in the tech industry, poses significant challenges to businesses. Outdated technology can lead to decreased productivity, increased maintenance costs, and a loss of competitive edge.

In a world dominated by the relentless march of technology, we have all felt the dizzying pace of change. But what if we told you that your cherished gadgets are not just evolving – they’re depreciating at a mind-boggling rate, faster than you ever imagined?

So, which of all the consumer gadgets on the market have lost the most value over time and which of the world’s big-name brands claim the most depreciated tech products?

Key Findings

- OnePlus gadgets experience a yearly value appreciation of 21.82%, surpassing all other tech brands.

- The Samsung Galaxy S22 has witnessed a significant 40% decrease in its value, the highest among all smartphones.

- The iPhone 14 has depreciated by 24.68%, outpacing the devaluation of any other Apple gadget.

- The Microsoft Surface Pro 7+ has seen the most significant drop in value, with a 35.23% decline since 2021.

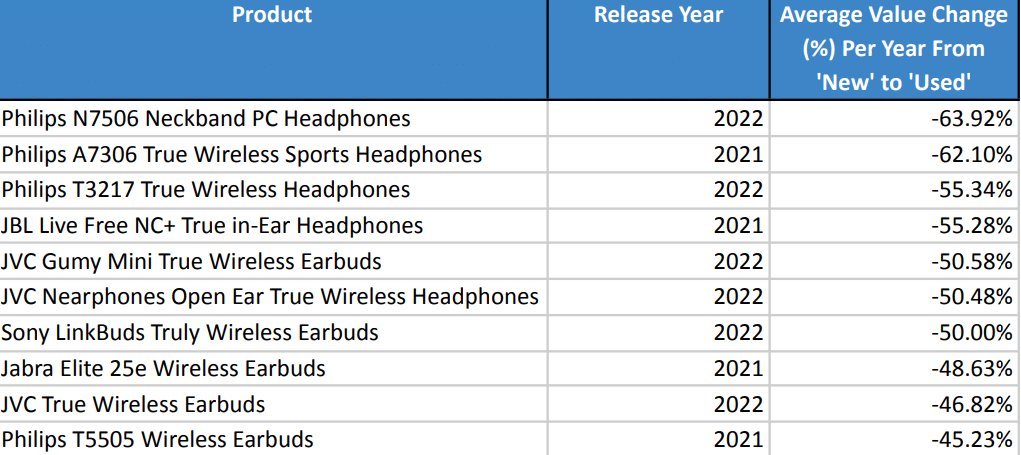

- Three Philips brand headphones are ranked as the audio technology that has suffered the most devaluation since their release.

To identify the consumer tech brands and products experiencing the most significant depreciation in value over time, a comprehensive analysis was conducted. Examined was 29 prominent consumer tech brands specializing in smartphones, earbud headphones, tablets, and smartwatches.

The research team collected data on over 1,000 tech products listed in “used” condition on both Amazon U.S. and UK. They then conducted a comparison between the original manufacturer’s suggested retail price (RRP) in USD when the products were brand new and their current standardised listed prices in “used: like new” condition.

For each individual product, they calculated the average change in value (%) per year since its initial release. In cases where multiple products within the same product line were released in the same year (e.g., iPhone 14, 14 Plus, 14 Pro, and 14 Pro Max), the team selected the product from that year’s lineup that exhibited the most significant annual change in value between new and used conditions.

The brands were subsequently ranked based on the average change (%) in value per year for all of their listed products that had available pricing information on Amazon.com and Amazon.co.uk at the time of the research.

It’s important to note that this data reflects only the products and prices accessible on these two Amazon platforms during the research period.

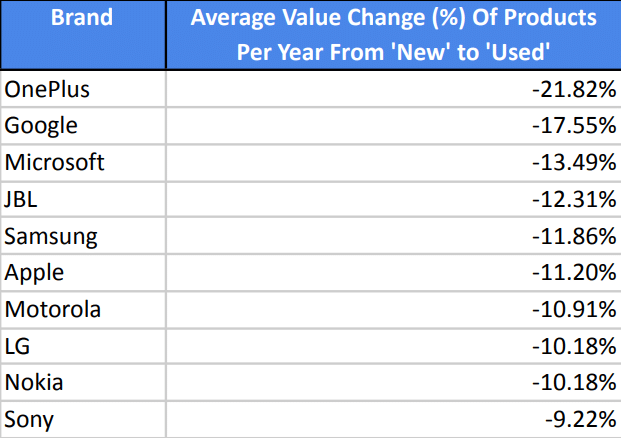

The Consumer Tech Brands Whose Products Lose the Most Value Over Time

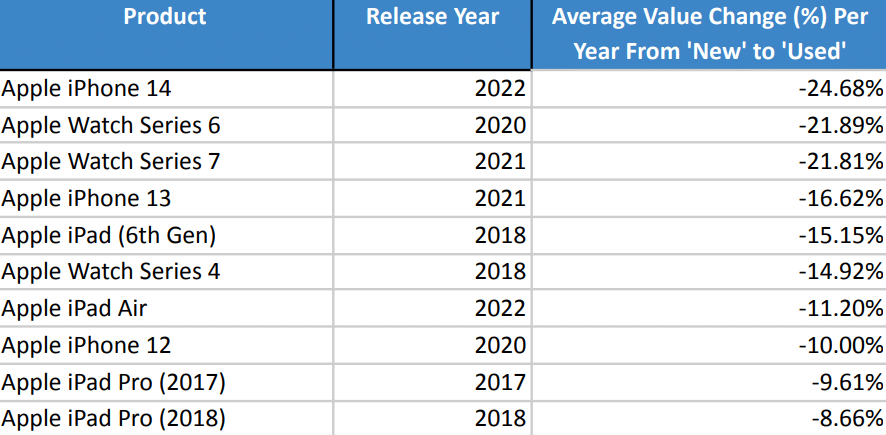

Apple Products That Lose the Most Value Over Time

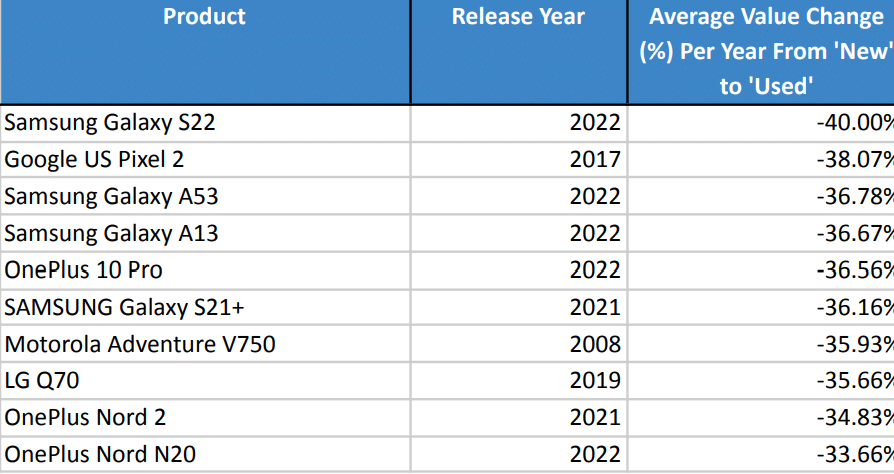

Smartphones That Lose the Most Value Over Time

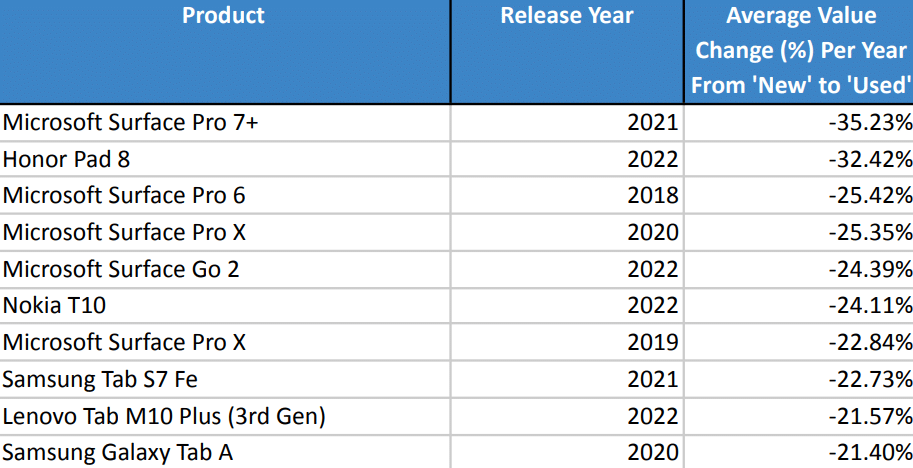

Tablets That Lose the Most Value Over Time

Earbuds & Headphones That Lose the Most Value Over Time

OnePlus Technology Loses the Most Value Over Time

From smartphones to headphones, it’s evident that our affinity for gadgets is strong. In the year 2023 alone, the consumer technology industry amassed a staggering global revenue exceeding $1 trillion, and this figure is expected to see a continuous annual growth of 2.32%. If you find yourself navigating this market, seeking a new technological marvel, the plethora of prominent brands vying for your attention can be overwhelming.

Simultaneously, the escalating cost-of-living crisis has prompted a growing number of individuals to contemplate the resale value of their tech acquisitions.

In fact, a survey conducted in the United Kingdom revealed that two out of every three adults are more inclined to invest in a high-priced device if they can anticipate a guaranteed return through resale.

When examining the typical decline in value between ‘new’ and ‘used’ products on Amazon, OnePlus emerges as the frontrunner, experiencing the most substantial depreciation, with an average tech item losing 21.82% of its value over time.

The brand often encounters issues such as rapid battery depletion and unresponsive screens with their smartphones. It’s plausible that consumers may hesitate to invest in second-hand models, even when they come at a lower price, due to their known propensity for problems.

In the second position, we find Google, with an average product devaluing by 17.55% each year. Notably, Aaron Gordon, writing for Vice Magazine, bemoans the discontinuation of security updates for the Pixel 3, a model introduced in 2018.

This raises the question of whether devices lacking proper security maintenance may indeed be less desirable in the resale market.

Apple iPhone 14 Depreciates More in Value Than Any Other Apple Gadget

Apple, renowned as the world’s premier technology brand, has unveiled an impressive array of gadgets, from the iPhone to the Apple Watch. However, the question arises: which of their products has suffered the most significant depreciation in value?

Surprisingly, despite its relatively recent release in September 2022, the Apple iPhone 14 has experienced the most substantial loss in value, with a staggering depreciation of 24.68% since its initial launch.

According to the reselling company SellCell, this sharp decline in resale value can be attributed to a combination of the phone’s steep initial cost and its underwhelming new features:

Consider the original iPhone, released back in 2007; although it’s aged, a pristine unit managed to fetch a staggering $39,339 in sales last year. It raises the possibility that the reduction in production of the iPhone 14 could potentially bolster its worth in the years ahead.

Four Samsung Smartphones Among The Models That Have Lost the Most Value Since Release

An analysis encompassing smartphones from various brands reveals that Samsung commands a significant presence in the list of top ten phones experiencing the most substantial annual depreciation since their initial release.

Notably, the leading model in this regard is the Samsung Galaxy S22, which has seen a considerable decline of 40% in its value since its debut in 2022. Furthermore, the Galaxy A53, A13, and S21+ also feature prominently in these rankings.

In contrast to Apple, which has introduced a comparatively modest 38 iPhone models since 2007, Samsung is a notably prolific brand in the realm of smartphone releases. In fact, in the year 2014 alone, Samsung launched an impressive total of 56 different models.

This prolific output might explain why the value of Samsung’s offerings tends to diminish rapidly, as there always seems to be a new Samsung smartphone just around the corner.

Securing the second spot is the Google Pixel 2, a model that has exhibited an average annual depreciation of 38.07% since its initial release in 2017.

Notably, Google has imposed a maximum trade-in value for Pixel phones at $205, with even the original Pixel from 2016 fetching a trade-in value as low as $25.01.

Microsoft Surface Pro 7+ Depreciates in Value More Than Any Other Tablet

Despite not enjoying the same level of popularity as Apple and Samsung in the tablet market, Microsoft has managed to secure half of the positions in our rankings of the top 10 tablets that have seen the most significant depreciation in value since their initial release.

Leading the pack is the Microsoft Surface Pro 7+, which has experienced an average annual depreciation rate of 35.23% since 2021.

Originally marketed exclusively to businesses and educational institutions, Microsoft had promised that the new Pro 7+ would offer nearly five additional hours of battery life compared to its predecessor, the Pro 7.

Users’ experiences didn’t align with these promises...

As Adam Shepherd notes in ITPro, “In practice, we found that not only did the Surface Pro 7+ fail to provide a full day’s worth of usage before running out of power, but it actually performed noticeably worse than the Surface Pro 7.”

Following closely is the Honor Pad 8, bearing the Honor brand, which has witnessed a depreciation of 32.42% from its original value since 2022.

Diverging from the Microsoft and Apple tablet landscape, this device operates on the somewhat less glamorous Android OS, which is occasionally plagued by issues such as inadequate update support.

Marshall Honorof of Tom’s Guide captures this sentiment, stating, “Android tablets occupy a functional no-man’s-land between smartphones and laptops,”

“An Android tablet essentially performs the same tasks as these two devices but does so with notably inferior results,”

Philips N7506 Top the Headphone/Earbud Models – Lost The Most Value

When it comes to headphones and earbuds, the Philips brand claims the top three models in our rankings of the gadgets that have lost the most value over time, with the N7506 Headphones taking the overall top spot (a 63.92% loss in value since 2022).

Scoring a fairly poor average score of 2.5 out of 5 on Amazon, could it be that they’re just not a promising pair to invest in at all, let alone second-hand?

Earbud products (with in-ear buds) take up other spots in our rankings, including the JVC Gumy Mini True Wireless Earbuds (a 50.58% drop in value since 2022).

When new earbuds can be bought inexpensively, it could be that second-hand in-ear buds just aren’t a worthwhile investment, given the health problems that can arise from the bacteria found in used audio gear.

Is Recycling Tech Better Than Trashing It?

As you excitedly unwrap your latest smartphone, tablet, or headphones, it’s easy to overlook the environmental consequences of discarding your old gadgets. However, the reality is that electronic waste, or e-waste, poses a significant threat to our planet.

Every year, consumers contribute to this problem by generating a staggering 50 million tons of e-waste, which is equivalent to discarding 1,000 laptops every second.

One effective way to combat this issue is by choosing to recycle your tech products, a responsible step that can help divert them from ending up in landfills.

Beyond environmental benefits, recycling can also play a crucial role in addressing the “digital divide” – a situation where lower-income communities lack access to technology.

By donating your used gadgets to charitable organisations that specialize in refurbishing and redistributing them to those in need, you can contribute to closing this gap and promoting digital inclusivity.

Mitigating The Effects of Tech Depreciation

To mitigate the effects of tech depreciation, consumers are encouraged to consider several strategies:

- Buy Last Year’s Model: Instead of always opting for the latest release, consider purchasing a slightly older model, which can offer a substantial reduction in price while still providing excellent performance.

- Protect Your Investment: Invest in quality protective cases, screen protectors, and insurance to ensure your devices remain in good condition, increasing their resale value.

- Consider Trade-In Programs: Many manufacturers and retailers offer trade-in programs that allow you to exchange your old device for credit toward a new one.

- Subscription Services: Evaluate whether subscription services offered by manufacturers are cost-effective for your usage patterns. These services often include regular upgrades and can reduce the impact of depreciation.

- Resale Market: Explore options in the resale market, as there may still be a demand for your older devices, particularly if they are well-maintained and in good condition.

Consumer Electronics Market Outlook (2023 to 2033)

The consumer electronics market is poised for continuous growth, with a projected Compound Annual Growth Rate (CAGR) of 5.8% throughout the forecast period.

In 2023, this market already commands a substantial share, estimated at US$ 3.3 trillion, and it anticipates a significant revenue increase, with expectations reaching US$ 5.8 trillion by the year 2033.

This robust growth trajectory reflects the ever-increasing demand for consumer electronics products and services, driven by technological advancements, evolving consumer preferences, and a growing global population

Tech Deprecation Summary

The gadgets and devices that were once the pride of their owners are now losing value faster than ever before, raising questions about the long-term sustainability of tech investments.

One of the primary reasons for this rapid depreciation is the breakneck speed of innovation in the tech industry. Smartphones, tablets, laptops, and other gadgets are being replaced with newer, more powerful models at an astonishing rate.

Manufacturers are constantly introducing new features, improved specifications, and cutting-edge designs, enticing consumers to upgrade regularly.

Market dynamics also play a significant role in the depreciation of consumer tech. Fierce competition among manufacturers has led to aggressive pricing and frequent promotional offers, which, while benefiting consumers initially, contribute to faster depreciation rates.

Additionally, the rise of subscription services and leasing options has changed how consumers approach tech ownership so many people now prefer to lease their devices, effectively reducing their long-term financial commitment while ensuring access to the latest models.

Consumers need to start adapting their purchasing strategies and consider the trade-offs between owning and leasing devices. So, if this is done with careful planning and informed decisions, it is possible to navigate the world of consumer tech while managing the impact of depreciation on one’s investments.