The volume, variety, and velocity of data in businesses is creating new challenges for every business function. And while the impact of not having access to the right data at the right time can impact any business function, when the finance team can’t access accurate data when needed, there can be a material effect on an organisation’s viability.

Financial data no longer lives solely in the database of a general ledger system sitting in an on-prem data centre. It can be found in CRM systems where deals, forecasts and sales targets are held. Salary information is held in HR systems, and, for larger organisations, there may be multiple general ledgers that need to be consolidated. And those systems might be a combination of cloud, on-prem and hybrid, each with its own security and access rules.

Finance businesses and teams drowning in too much data in too many places might be tempted to try to reinvent the wheel and consolidate all their data – or at least the subset that they can bring in most easily. But this is slow, costly, and risky in an age of increased governance and regulation.

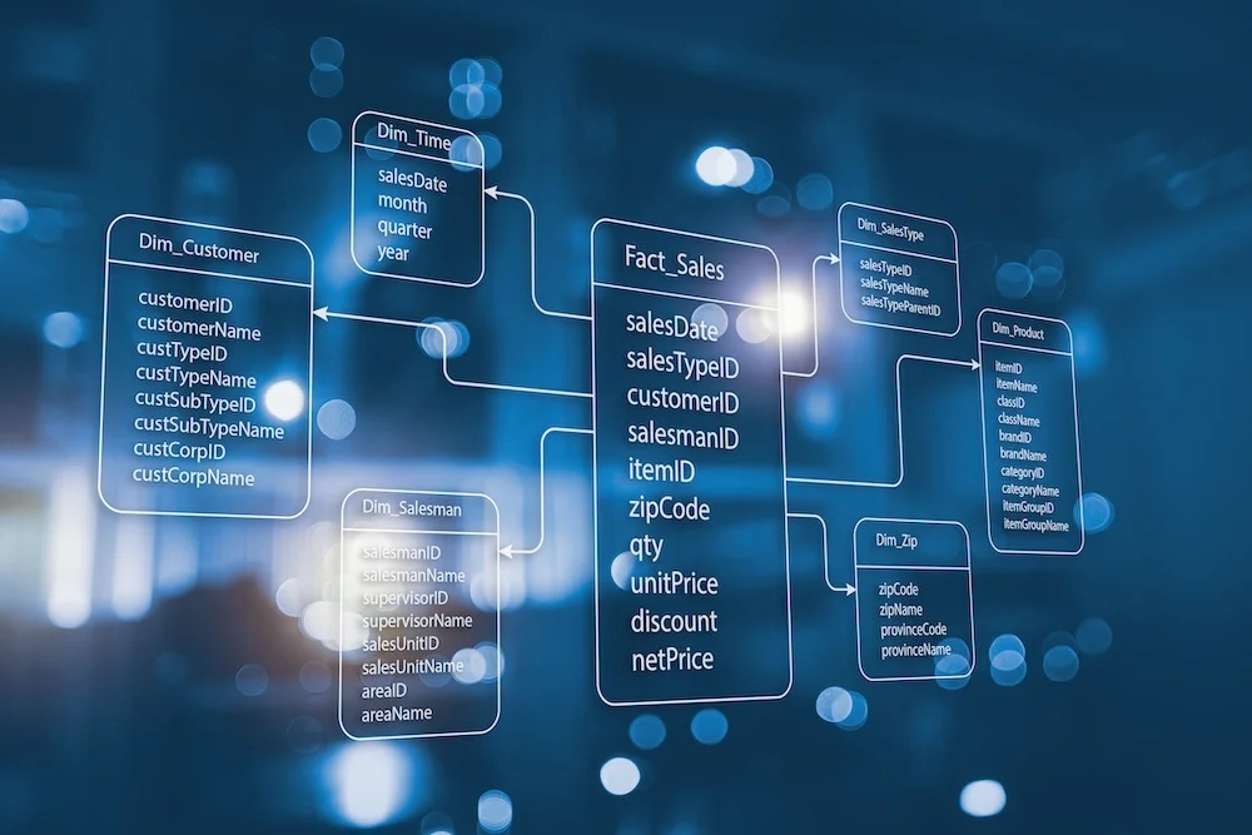

Bringing that data together has been a challenge that has typically been partially met by extracting data, transforming it to comply with a particular structure and then loading it into a new database. And while ETL (extract, transform, load) can work in some cases, it is not suitable for all data types and sources.

A single view is possible, ensuring you can leave the data in the various locations, only joining the data when you need a question answered. This new approach enables businesses to query data in situ. Instead of bringing the data into a central location for querying, the query is sent out to each data source and the answer is delivered without moving or copying data. This is called data virtualisation.

This can save time, money and minimise the risk of data being accessed by an unauthorised party. A modern data integration platform that employs data virtualisation, real time ETL, change data capture, streaming and replication can bring this to fruition.

A more diverse approach means each data source can be accessed in the most efficient and secure way. This enables finance teams to create a single view of all the data that is important to them without being subject to the limitations of a single data access method.

For example, sales data that is constantly changing can be streamed into a virtual data lake, providing real time access to information. If that data is on a cloud service, APIs can enable access through secured channels. With data that only changes periodically, such as forecasts, ensures that only variations in the source data are captured rather than entire data sets.

Rather than the only tool in the data analytics box being the ETL hammer, finance teams can access the right tool for each different data source they require access to.

It’s often said that finance is the language of business. And for finance to understand what is happening within a business it needs access to all the entire lexicon of financial information wherever it is stored. The ability for finance teams to gain a complete view of all pertinent data is a powerful enabler for organisations.

For organisations in the throes of mergers, acquisitions, and divestments, being able to easily connect and disconnect different data sources can vastly simplify their ability to produce accurate and up-to-date financial information. And when organisations have a full picture of the flow of money, projections and forecasts they can make better and faster decisions.

Traditional approaches to data analytics were costly, complex, and rarely delivered on their promise of better support for decision making. By adopting a modern data integration platform, organisations can choose the tools that work best for their specific data access needs.