- PATH: +1.43%

- PLTR: +4.23%

- ACN: +0.55%

KEY POINTS

- The big names in AI have gained an average of 125% since the start of 2023.

- It’s time for investors to look outside these names for the next massive winners.

- These three under-the-radar stocks deserve more attention.

- 10 stocks we like better than Palantir Technologies

After Big tech crushing the playing field it in 2023; who will provide the next huge gains in 2024?

In 2023, amidst the absence of recession or inflation, the focal point shifted towards the surge in artificial intelligence (AI) and big tech stocks. This led to the emergence of the “Magnificent Seven,” comprising mega-cap tech stocks such as Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla.

Since the onset of 2023, these stocks have collectively surged by an average of 125%. While Nvidia has recorded an impressive 322% gain, caution is warranted as some stocks appear to be overvalued. For instance, Microsoft currently trades with a price-to-earnings (P/E) ratio of 39, compared to its five-year and 10-year averages of 31.

Astute investors are exploring alternative avenues for significant gains in AI, with several compelling options available. Here are three worth considering.

UiPath Is At The Forefront Of Robotic Process Automation

Consider the significant boost in productivity achievable through automating your most mundane and time-consuming office tasks.

Now envision the exponential increase in productivity for an entire company when its employees can dedicate their efforts to high-value, strategic business activities. It encapsulates the essence of robotic process automation (RPA) with UiPath (NYSE: PATH).

For instance, in a notable case study involving UiPath, a large manufacturer dealing with thousands of vendors and tens of thousands of invoices managed to slash processing time from 7-10 days down to a single day.

Simultaneously, despite a 150% increase in workload, the company only needed a minimal 5% increase in staff. The implications for profitability are profound and undeniable, underscoring the likely sustained demand for UiPath’s offerings.

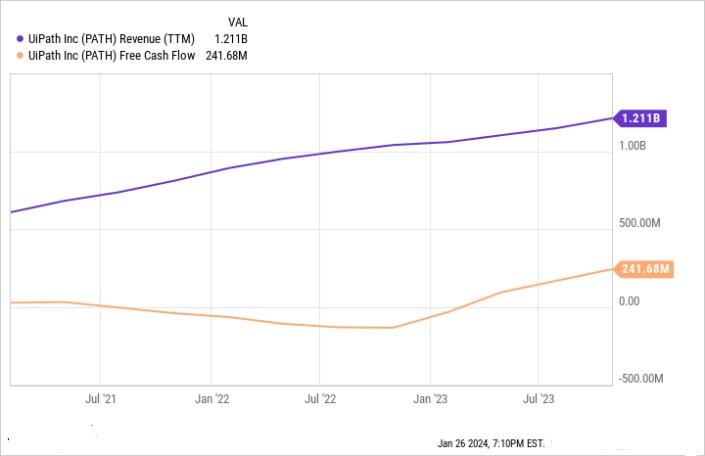

UiPath boasts a robust customer base exceeding 10,000, with an impressive annual recurring revenue (ARR) of $1.4 billion and a solid financial foundation highlighted by $1.8 billion in cash and investments, and no long-term debt. Notably, revenue has doubled since the onset of 2021, and UiPath has achieved positive free cash flow, as evidenced by the figures below.

The company has yet to turn a profit, a common scenario for small, emerging tech firms. UiPath faces its greatest threat from intense competition, particularly from well-funded giants like Microsoft.

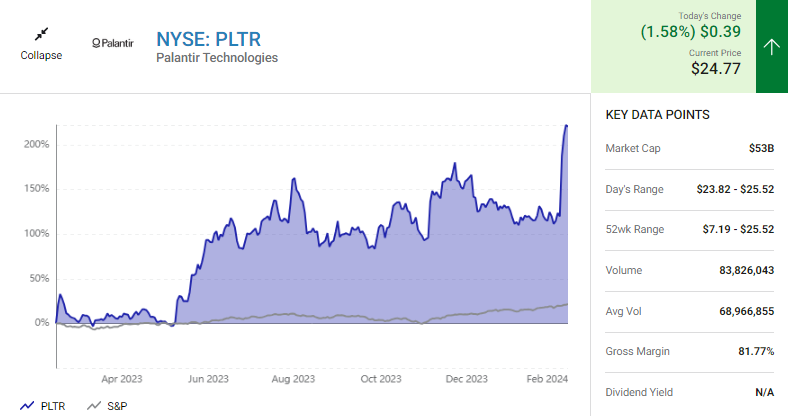

With its stock trading at 10.5 times sales, UiPath presents a competitive option compared to other AI companies like Palantir Technologies (NYSE: PLTR) which trades at 17 times sales.

As businesses increasingly prioritise productivity, the demand for Robotic Process Automation (RPA) is expected to surge, making UiPath an attractive prospect for investors focused on AI.

Palantir: A Shining Beacon In Data Analytics

Few companies rival Palantir’s expertise in artificial intelligence. It’s platforms excel in handling vast volumes of data and generating actionable insights.

In today’s data-rich environment, many entities, both corporate and governmental, struggle with effectively managing, visualising, and utilising their data due to a lack of expertise. Palantir’s Foundry and Gotham platforms are specifically designed to address this challenge.

Palantir unveiled its Advanced Intelligence Platform (AIP) in April 2023, catering to businesses and defense departments. The platform harnesses the power of large language models, similar to those fueling generative AI like ChatGPT, to make critical real-world decisions, sometimes of life-or-death importance.

For example, Palantir’s defense demonstration showcases AI analysing actual visual imagery of enemy combatants to predict likely enemy formations, highlighting the platform’s significance and value in such contexts.

In the trailing 12 months leading up to the third quarter of 2023, Palantir generated $2.1 billion in revenue, marking a 16% growth rate. Notably, the majority of Palantir’s revenue comes from government contracts, offering stability and substantial opportunities given defense departments’ consistent needs and financial resources.

Furthermore, Palantir’s commercial sales experienced a robust 33% year-over-year growth last quarter, surpassing government growth, thus positioning Palantir favorably in both sectors.

Despite Palantir’s higher valuation compared to UiPath based on price-to-sales (P/S) metrics, Palantir boasts profitability according to generally accepted accounting principles (GAAP), a feat it has maintained for the past four consecutive quarters.

Moreover, Palantir’s balance sheet is exceptionally strong, featuring $3.3 billion in cash and investments and zero long-term debt. Given these factors, every investor interested in artificial intelligence should consider Palantir as a potential investment opportunity.

Accenture: Consulting For The Elite

Accenture’s cautionary tales remain ingrained in business management studies and collective consciousness.

Blockbuster’s failure to seize the opportunity with Netflix, a mere $50 million investment that could have yielded astronomical returns (Netflix now valued at $246 billion), and Borders’ succumbing to the rise of online retail giant Amazon serve as stark reminders of the importance of adapting to evolving landscapes.

Enter Accenture (NYSE: ACN), a consulting powerhouse that guides companies through technological integration, product design, operational enhancements, and strategic development, including the incorporation of AI and data analytics.

Collaborating with industry leaders like Amazon, Accenture stands as a stalwart amid the digital transformation, leveraging its maturity, profitability, and dividend payouts (1.3% yield) to attract investors seeking stability.

Despite a slightly elevated P/E ratio of 34 compared to its five-year average of 29, Accenture anticipates a 6% to 9% increase in earnings per share for fiscal year 2024, poised to capitalize on the ongoing AI revolution.

While the high-growth “Magnificent Seven” enjoyed remarkable success in 2023, investors may find some of these names too volatile. Instead, attention may turn to lesser-known companies also riding the AI wave in 2024.

AI Stocks With The Most Momentum

Momentum investing is based on the principal that stocks that have increased at a faster rate compared with the market or their peers are likely to continue on that trajectory, at least in the short term, as long as there aren’t fundamental changes to those companies’ operations or the broader industry.

Below, we look at the AI stocks that have provided the highest total return in the last 12 months.

| AI Stocks With the Most Momentum | |||

|---|---|---|---|

| Price ($) | Market Cap ($B) | 12-Month Trailing Total Return (%) | |

| Nvidia Corp. (NVDA) | 612.27 | 1,512 | 223.7 |

| Meta Platforms Inc. (META) | 391.01 | 1,005 | 176.9 |

| Advanced Micro Devices Inc. (AMD) | 178.84 | 288.9 | 145.3 |

- Nvidia Corp.: A chip manufacturer that provides computer graphics processors, chipsets, and related software, Nvidia was the best-performing stock in the S&P 500 for 2023, more than tripling in value during the year.5

- Meta Platforms Inc.: Formerly known as Facebook, the company operates social media and entertainment platforms including Facebook, Instagram, WhatsApp, and Messenger. The company’s advertising revenue has sharply rebounded, leading to record sales in the last quarter reported.6

- Advanced Micro Devices Inc.: A maker of semiconductors, Advanced Micro Devices is known as AMD. It provides chips for computing, graphics, enterprise, embedded, and semi-custom applications.

Best Value AI Stocks

Value investing is a strategy based on the principal that some stocks trade at prices that are below their intrinsic value. Investors able to identify these stocks, usually through analysis of fundamental metrics, may be primed for a return on their investment when the market corrects the mispricing and the stocks rise.

One such metric is the price-to-earnings (P/E) ratio. Lower P/E ratios are generally considered to be signs of a more attractively valued company since it is valued at less than its fundamental value.

| Best Value AI Stocks | |||

|---|---|---|---|

| Price ($) | Market Cap ($B) | 12-Month Trailing P/E Ratio | |

| Alibaba Group Holding Ltd. (BABA) | 73.94 | 188.9 | 10.2 |

| Aptiv PLC (APTV) | 83.16 | 23.5 | 10.4 |

| JD.com Inc. (JD) | 23.91 | 31.5 | 11.2 |

- Alibaba Group Holding Ltd.: A Chinese e-commerce, cloud computing, and digital entertainment company. Alibaba offers a variety of online and mobile marketplaces and communities.

- Aptiv PLC: This Irish-American firm designs and produces auto parts, including those focused on connectivity, safety, and sustainability. Aptiv also provides vehicle software including AI and machine learning capabilities.

- JD.com Inc.: It is a Chinese e-commerce company and the largest retailer in China. In June 2023, the company announced a large language model (LLM) AI tool called ChatRhino for e-commerce, logistics, marketing, and eventual enterprise use.

AI Market Stocks Summary – 2024

The three AI stocks analysed – PATH, PLTR, and ACN – have all demonstrated positive performance in 2024. PLTR stands out with the highest increase at +4.23%, reflecting strong potential for growth and market confidence in its AI-related endeavors.

PATH follows closely behind with a respectable increase of +1.43%, indicating steady progress and investor interest. ACN, while showing a more modest rise at +0.55%, still presents a positive trajectory in the AI sector.

Overall, these stocks showcase promising prospects in the AI industry for 2024, with PLTR leading the pack in terms of potential outperformance. Investors may consider these stocks for their portfolios based on their individual risk tolerance and investment objectives.