Amazon remains a powerhouse in the e-commerce landscape, hosting approximately 9.7 million sellers who are eager to enhance their sales and profits. But what does it take for new sellers to succeed on this platform?

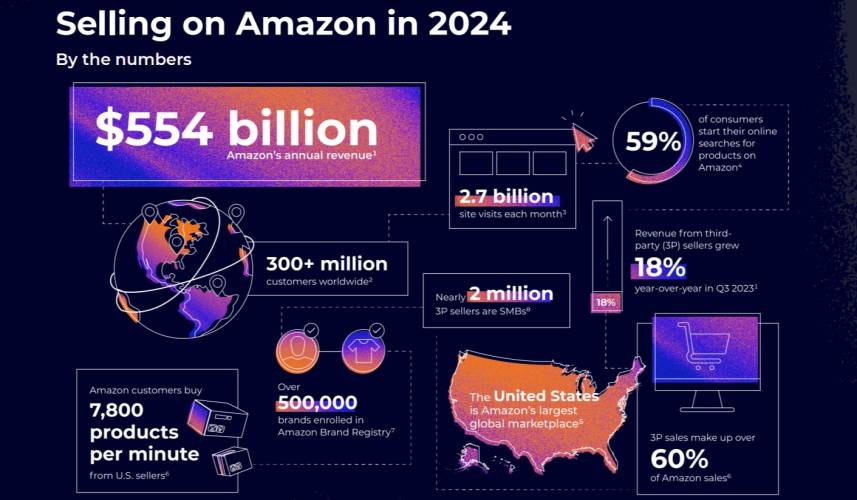

With nearly 60% of all Amazon sales attributed to third-party sellers, there is substantial opportunity for emerging entrepreneurs. However, competition is intense, as only about 10% of these sellers earn over $100,000 annually.

In this article, we’ll explore key insights from the latest Amazon seller statistics for 2024, covering sales trends, revenue details, top-performing categories, and more.

Amazon Seller Statistics 2024: Quick Highlights

- Total Sellers: Over 9.7 million sellers registered, with 1.9 million actively selling.

- Projected Growth: An additional 1.3 million new sellers are expected to join by 2025.

- Third-Party Sales: 60% of Amazon’s sales come from third-party sellers.

- Active U.S. Sellers: Over 1.1 million active sellers in the United States.

- Average Annual Sales: Amazon sellers average over $230,000 in annual sales, with more than 60,000 surpassing $1 million.

- FBA Usage: 82% of sellers utilise Fulfillment by Amazon (FBA).

- Top Categories: Home & Kitchen is the leading category, with 35% of sellers listing items in this segment.

- Advertising Revenue: Amazon Advertising generated $46.9 billion in revenue in 2023.

- Prime Day Sales: U.S. sales during Amazon Prime Day 2024 reached over $14.2 billion.

Number of Amazon Sellers in 2024

As of this year, Amazon has a total of 9.7 million sellers, with about 2 million actively listing products. Since the beginning of 2024, the platform has welcomed approximately 839,900 new sellers, averaging around 3,700 new registrations daily. By year’s end, the number of new sellers is projected to reach 1.3 million.

Globally, Amazon boasts over 310 million active users, with 80% based in the United States.

Types of Amazon Sellers

The seller landscape includes two primary categories: Third-party (3P) and First-party (1P) sellers.

- 3P Sellers: 68% of sellers, managing their own sales.

- 1P Sellers: 40% of sellers, who sell products directly to Amazon.

In 2023, U.S. Amazon sellers sold over 4.5 billion items, averaging 8,600 products sold every minute.

Sales and Revenue Insights

In 2024, the average annual sales for Amazon sellers exceed $230,000, with over 60,000 sellers achieving annual sales over $1 million.

Average Monthly Sales Breakdown

- Under $500: 31%

- $501-$1000: 17%

- $1001-$5000: 22%

- $5001-$10,000: 11%

- $10,001-$25,000: 7%

- $25,001-$50,000: 5%

- $50,001-$100,000: 4%

- Over $100,000: 1%

Seller Profitability

More than 44% of Amazon sellers report profit margins above 15%. Additionally, 57% of sellers achieve a net profit margin over 10%.

Seller Demographics

- Geographical Distribution: The U.S. accounts for 55% of Amazon sellers, followed by the U.K. (7%) and Canada (6%).

- Age Groups: The largest seller demographic is between 25-34 years old (33%).

- Gender: 67% of sellers are male, while 30% are female.

- Education: 40% of sellers hold bachelor’s degrees.

Business Models and Fulfillment Methods

The most common business model among Amazon sellers is Private Label, used by 54% of sellers. Other models include Wholesale (25%) and Retail Arbitrage (25%).

Fulfillment Methods:

- FBA: 82% of sellers use this method, benefiting from increased visibility and sales.

- FBM: 34% of sellers manage their own fulfillment.

Challenges Facing Amazon Sellers

Sellers face various challenges, with customer reviews and product research topping the list. Additionally, rising costs related to advertising and shipping are major concerns for over a third of sellers.

Trending Product Categories

The most popular category among sellers is Home & Kitchen (35%), followed by Beauty & Personal Care (26%) and Clothing (20%).

Product Sourcing

Seventy-one percent of U.S. sellers source their products from China, reflecting a reliance on international supply chains.

Pricing Strategies

A significant majority (61%) of Amazon sellers price their products between $16 and $50, considering various costs and competitor pricing.

Conclusion (Summary)

Navigating the Amazon marketplace requires a mix of time, financial investment, and strategic marketing. With over 48% of sellers leveraging AI tools, the future looks promising for those who adapt and innovate.

Amazon Prime Day 2024

The 2024 Prime Day set new records, generating over $14.2 billion in U.S. sales—a significant increase from previous years. Over 300 million items were purchased globally during the event, highlighting Amazon’s immense reach and the potential for seller growth.