Falling deeper into correction territory after Nasdaq tumbles 2%

U.S. stocks tumbled on Friday, closing out a losing week and continuing a rough start to 2022. The Nasdaq Composite was hit the hardest with Friday’s selling sending the tech-heavy index to its worst week since 2020.

The Nasdaq Composite declined 2.7% to 13,768.92 on Friday. The Dow Jones Industrial Average fell 450.02 points to 34,265.37. The S&P 500 slid 1.9% to 4,397.94.

The Nasdaq posted a 7.6% loss for the week, its worst since October 2020, and now sits more than 14% below its November record close. Both the Dow and S&P 500 closed out their third straight week of losses and their worst weeks since 2020. The S&P 500 is off more than 8% from its record close

Netflix’s disappointing earnings report is the latest setback for tech investors. Shares of the streaming giant fell 21.8% on Friday after the company’s fourth-quarter earnings report showed a slowdown in subscriber growth. Shares of its peers also declined, with Dow component Disney, which operates the Disney+ streaming service, falling 6.9%.

Netflix is the first major tech company to report earnings this season, with Apple and Tesla due to announce earnings next week. Tesla lost 5.3% on Friday. Shares of other technology companies such as Amazon and Meta Platforms fell 6% and 4.2%, respectively.

Big losses in growth stocks have pushed the Nasdaq Composite even further into corrective territory as rising rates put pressure on tech stocks, making high valuations less attractive.

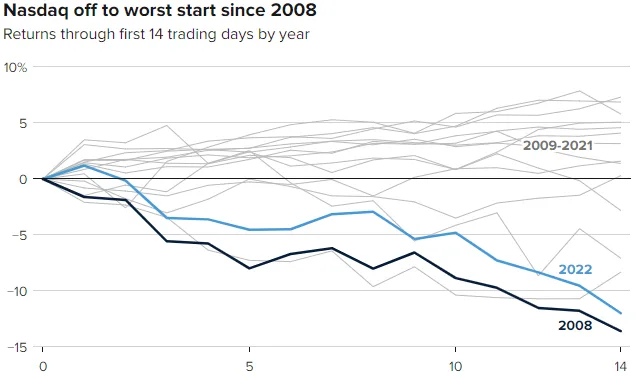

The Nasdaq is off to its worst start to a year, through the first 14 trading days, since 2008.

“Given the emotional decline in the stock market of the last few days, fundamentals have been suspended as market action is entirely tied to technical support levels,” said Jim Paulsen, chief investment strategist at Leuthold Group.

“Until a level is reached in this collapse… fundamentals like bond yields, economic reports and even earnings releases will not likely have much impact. Fear now must be extinguished by some stock market stability before traders and investors again start to consider fundamental drivers,” added Paulsen.

The Nasdaq Composite struggle is largely driven by a rise in government bond rates this week. The 10-year US treasury hit 1.9% on Wednesday as investors focused on the schedule of interest rate hikes and widespread tightening by the Federal Reserve. However, bond yields fell on Friday.

Investors will now turn their attention to the January two-day meeting on Federal Reserve policy, due to begin on Tuesday.

“While a handful of rate hikes over the next year or two would represent a shift in Fed policy, we wouldn’t consider policy restrictive and we don’t expect the initial rate increase to derail the economic recovery,” said Scott Wren, senior global market strategist at Wells Fargo Investment Institute. However, he added that rate hikes will inject volatility into the market.

Friday’s sales intensified to close, continuing the worrying pattern early in the year. According to Bespoke Investment Group’s analysis until Wednesday, the S&P 500 index fell by an average of 0.16 percentage points in the last trading hour in January. This average last hour performance puts January at the lowest 1% of all months and the third worst since 2000, Bespoke determined

Small caps were also hit hard this week. The Russell 2000 secured its worst week since June 2020. The index fell 1.8% on Friday.

Bitcoin was also hit hard on Friday as investors braced themselves for the Fed to dump riskier assets with higher yields. The digital asset fell more than 10% on Friday to around $38,233.

– CNBC’s Nate Rattner and Patti Domm contributed reporting.