Since its іnсeрtion in 2007, the concept of banking-as-a-service (BaaS) has undergone notable advancements and transformations over the years. However, it is still not a widely adopted technology across all industries.

Banks are one such segment where BaaS adoption rates are low due to several reasons including lack of awareness about BaaS solutions, security concerns, and lack of understanding as to how they can benefit from adopting this technology.

Banking As-A-Service (BaaS) Market size was valued at USD 637.40 Billion in 2022 and is projected to reach USD 6,943.49 Billion by 2030, growing at a CAGR of 32.9% from 2024 to 2030

The growth of the BaaS market is fueled by several factors, including rapid digital transformation, the emergence of innovative new players, and the widespread use of Application Programming Interfaces (APIs).

Leading custom software development company “Itexus” recently published a list of the 10 best Banking-as-a-Service Platform development companies.

In a blog post it Itexus said, “In financial services, Banking-as-a-Service (BaaS) platforms have emerged as a key component of open banking,”

“More and more tech-savvy legacy banks are now developing their own BaaS platforms to take advantage of Open Banking opportunities ahead of their competitors and to create new revenue streams by monetizing their platforms,”

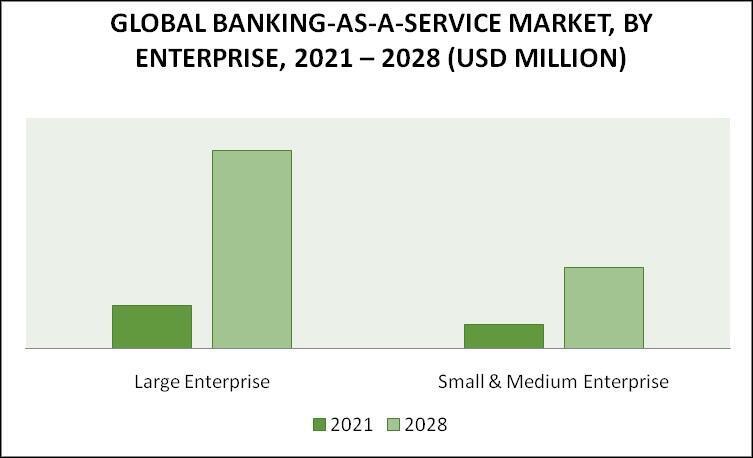

Banking As-A-Service (BaaS) Market, By Enterprise – 2021 – 2028

- Large Enterprise

- Small & Medium Enterprise

The market is segmented based on enterprises into two categories: Large Enterprises and Small & Medium Enterprises (SMEs). Among these, Large Enterprises hold the largest market share and are expected to experience the highest compound annual growth rate (CAGR) of 26.33% during the forecast period.

Large enterprises encompass a wide range of businesses, ranging from small proprietorships to large corporations employing thousands of individuals across multiple countries.

Organisations are also classified into various categories based on their business scale, including small-scale enterprises, micro-enterprises, large-scale industries, public enterprises, and multinational corporations. One of the key distinguishing factors between small and medium-sized enterprises and large enterprises is the number of employees working within the organisation.

In this article, we will try to understand what exactly is banking-as-a-service. What are some key components of BaaS? How does it help banks transform their business models and remain relevant in today’s digital economy?

Key Components of Banking-as-a-Service

BaaS is a cloud-based platform that provides the infrastructure, software, and services needed to build, deploy and manage a digital bank. It includes the following key components:

- Data Warehouse: Stores customer data from multiple sources in one place so it can be analyzed as needed by business teams.

- Data Lake: Stores unstructured data such as photos or videos in an immutable format (i.e., it’s never changed once written). This helps businesses uncover patterns within their customer base by allowing them to search for specific characteristics across all available sources of information about customers.

- API Management Layer: Lets developers, see the list of them here, access information stored in the data warehouse through APIs (application programming interfaces), which are prewritten sets of rules that allow two different software applications to communicate with one another without having knowledge of each other’s inner workings

Advantages and Benefits of Adopting Banking-as-a-Service

Banking-as-a-Service (BaaS) is a new paradigm for banks. It will help them to compete with fintech startups, innovate and reduce costs while increasing customer satisfaction.

Here are some of the advantages of adopting BaaS:

- Reduce Costs – BaaS is cheaper than trаdіtiоnal systems because it uses cloud computing services which are less expensive than owning your own hardware and software assets. This also means that you don’t have to hire an army of developers or spend millions on building out infrastructure such as servers and data centers either!

- Increase Customer Satisfaction – Customers expect more from their banks these days; they want faster service delivery, better experience when interacting with their bank (whether online or offline), etc., but for many institutions, this can be challenging due to budget constraints or lack of expertise in certain areas like cybersecurity protection, etc.

Enabling Financial Innovation through Banking-as-a-Service

Banking-as-a-Service (BaaS) is a key enabler of financial innovation. It enables fintech startups to focus on their core competencies and deliver new services faster, at lower cost.

It also allows non-financial institutions to offer new financial services without having to build an entire bank from scratch or hire thousands of employees in order to become licensed banks.

Moreover, banks can use BaaS as an alternative way of acquiring new customers without having to invest heavily in IT infrastructure development

Empowering Fintech Startups and Non-Financial Institutions with BaaS

Banking-as-a-Service (BaaS) is a game changer for fintech startups and non-financial institutions. It enables them to create new products and services, scale faster and reduce costs by leveraging existing infrastructure.

Future Outlook and Potential Disruptions in the BaaS Landscape

BaaS is still in the early stages of adoption and will continue to evolve over time. As a result, there are many potential disruptions in the BaaS landscape that could take place.

For example:

- A new bank could enter the market and offer banking services through its own BaaS platform or acquire an existing one like Monzo or Revolut. This would allow them to offer a better customer experience than traditional banks do today.

- The new entrant may also be able to undercut fees charged by incumbents because it doesn’t face regulatory compliance costs or legacy IT systems costs associated with running a traditional retail banking business model

Banks can leverage BaaS to transform their business models to remain relevant in today’s digital economy.

BaaS is a great way for banks to differentiate themselves from fintech startups. Fintechs have been disrupting the financial services industry, but there are many ways in which they are limited in their ability to serve customers.

BaaS can also be used by banks as a way of competing with non-banking institutions like Amazon and Google (whose recent partnership will allow Google users to pay bills directly through Gmail).

Key Players

The Global Banking As-A-Service (BaaS) Market exhibits a highly fragmented nature, characterised by a multitude of players operating on a global scale.

Among the major participants in this market are Green Dot Corporation, Solarisbank AG, PayPal, Square, Fidor Bank, Moven, Currency Cloud, MatchMove, Bnkbl Ltd, and Treezor.