In a recent report released by eToro, findings reveal that one in five retail investors in Australia are gearing up to bolster their investments in a select group of tech giants throughout 2024. The notable companies in focus include Amazon, Apple, Microsoft, Meta, Tesla, Nvidia, and Alphabet.

Based on a survey encompassing 1000 Australian retail investors, a significant portion, constituting 7 percent, expressed their intent to divest some of their holdings from the ‘Magnificent 7’ in 2024, aiming to lock in profits.

Moreover, 10 percent of respondents indicated plans to scale back on fresh capital injections into these corporations in the upcoming months. However, a considerable 42 percent revealed no intentions to alter their investment allocations.

The surge in interest in these companies follows a highly profitable 14 months, witnessing a collective 90 percent surge in their share prices since January 2023.

In terms of sector preferences for the year ahead, the report highlights a predominant inclination towards the tech sector, with 15 percent of Australian retail investors expressing favoritism, closely followed by financial services at 12 percent.

Despite minor fluctuations, the proportion of investors holding AI-related stocks remained steady, experiencing a slight dip from 20 percent to 19 percent in the initial quarter of 2024.

The trend underscores the enduring appeal of the ‘Magnificent 7’ as sought-after investments among Australian retail investors.

March ASX Technology Winners

| Code | Name | Price | Change | Market cap |

| TSK | TASK Group Holdings | 0.8 | 105% | $281,490,508.21 |

| NVQ | Noviqtech Limited | 0.006 | 100% | $7,436,536.48 |

| 360 | Life360 Inc | 13.09 | 68% | $2,638,371,931.20 |

| ASV | Asset Vision Co | 0.02 | 67% | $14,516,731.30 |

| AXE | Archer Materials | 0.57 | 58% | $146,537,032.48 |

| ADS | Adslot Ltd. | 0.003 | 50% | $9,673,486.64 |

| EXT | Excite Technology | 0.012 | 50% | $15,950,900.78 |

| EXT | Excite Technology | 0.012 | 50% | $15,950,900.78 |

| EML | EML Payments Ltd | 1.23 | 46% | $476,147,622.76 |

| FND | Findi Limited | 2.87 | 44% | $135,667,394.38 |

| SEN | Senetas Corporation | 0.021 | 35% | $29,854,383.94 |

| LNU | Linius Tech Limited | 0.002 | 33% | $10,393,481.43 |

| 1CG | One Click Group Ltd | 0.009 | 29% | $5,505,430.58 |

| PRO | Prophecy Internation | 0.77 | 28% | $54,851,320.83 |

Tech Mergers, Financial Triumphs, and Innovations:

TASK Group (ASX:TSK) has surged to the top of the tech winners’ chart following its acquisition announcement by PAR Technology Corporation (NYSE:PAR).

PAR is a leading global restaurant technology company and provider of unified commerce servicing more than 70,000 enterprise restaurants in 110 countries.

Shareholders of TSK now have the option to select between cash or PAR shares. The cash deal, valued at 81 cents per TSK share, represents an impressive 107 percent premium over the 30-day average price.

Life360 (ASX:360) unveiled its CY23 results in March, showcasing remarkable achievements across the board. The family safety services and location tech company reported consolidated revenue soaring by 33 percent to $305 million, aligning with its guidance range of $US300-$310 million.

Core subscription revenue witnessed a substantial 52 percent year-over-year increase to $200 million. Impressively, It achieved positive adjusted EBITDA of $20.6 million, surpassing its guidance range of $12-$16 million, and recorded positive operating cash flow of $7.5 million, marking a significant $64.6 million improvement from CY22.

The company aims to sustainably achieve positive EBITDA by the first half of CY25. Additionally, Life360 announced the launch of a new advertising revenue stream in CY24 and the full subscription service in Australia during Q2.

Life360 says it’s committed to a pathway to profitability and delivered positive adjusted EBITDA of $20.6 million, ahead of guidance of $12-$16 million and positive operating cash flow of $7.5 million, a $64.6 million improvement versus CY22.

Archer Materials (ASX:AXE) revealed the development of a miniaturised version of its Biochip graphene field effect transistor (“gFET”) chip. The Archer Biochip integrates a sensing region powered by multiple gFETs, each acting as a transistor sensor.

“The Archer Biochip contains a sensing region of which the gFET is the core component. Each gFET chip contains multiple gFETs, each of which is a transistor, which acts as a sensor,” the company says.

AXE successfully reduced the chip’s size by redesigning circuit layouts. Moreover, the company collaborated with École Polytechnique Fédérale de Lausanne (EPFL) to construct a single-chip integrated pulsed electron spin resonance (p-ESR) microsystem.

Gratifii (ASX:GTI) recently secured $1.6 million through the issuance of 320 million fully paid ordinary shares to new and existing sophisticated and institutional investors, including company directors.

In addition, Gratifii inked two new agreements with Aussie payments company subsidiary EML Payment Solutions, a wholly-owned subsidiary of EML Payments (ASX:EML), to provide prepaid debit cards to GTI’s Australian clients and broaden the array of rewards accessible to EML’s clients.

GTI says funds from the placement will be used toward additional capital technology development, inventory and working capital.

S&P/ASX 200 Information Technology (Sector) Overview

S&P/ASX 200 Information Technology (Sector) Overview

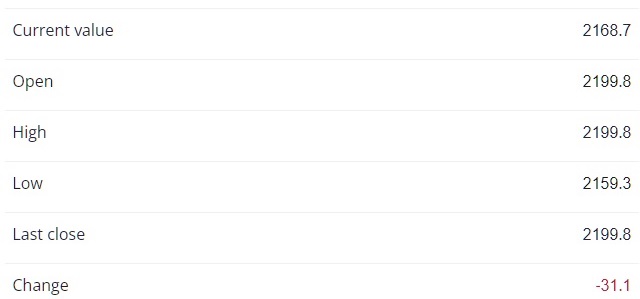

The S&P/ASX 200 Info Tech (ASX:XIJ) Index

The S&P/ASX 200 Info Tech (ASX:XIJ) index has demonstrated remarkable resilience and growth, solidifying its position as the top performer among the bourse’s sectors.

Despite a slightly slower pace in March compared to February’s exceptional surge, the tech sector has maintained its upward trajectory, registering a notable 2.87% increase.

Notably, tech stands out as the leading performer across all sectors on the ASX this year, boasting an impressive year-to-date surge of over 55%.

The sustained momentum underscores the enduring investor interest in technologies such as artificial intelligence (AI), which continues to drive optimism and opportunities within the tech industry.

3 Tech Stocks Wall Street Thinks Will Rise

What could be more impressive than Nvidia? Analysts speculate that these stocks might be on the rise.

Nvidia (NVDA 2.45%) has enjoyed immense favor on Wall Street recently. The chip giant saw a staggering surge of nearly 240% in 2023, with its shares climbing around 80% so far this year.

However, analysts are cautious about sustaining this blazing momentum. The consensus among analysts suggests that Nvidia’s future gains may be limited, with the projected price target barely exceeding its current share price.

Here are three stocks dubbed the “Magnificent Seven” by Wall Street, expected to outperform Nvidia in the next 12 months.

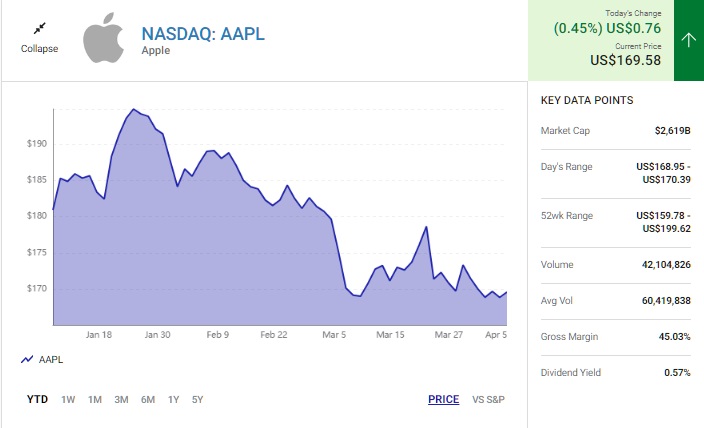

1. Apple

Apple (AAPL 0.45%) has been a laggard in 2024. It even lost the spot as the biggest company in the world, based on market cap, to Microsoft. However, analysts are more bullish about Apple than any other Magnificent Seven stock right now.

The average 12-month price target for Apple indicates a potential upside of over 9%. Out of the 36 analysts surveyed by LSEG in April, 32 rate the stock as a buy or a strong buy, while the rest suggest holding the stock.

The level of optimism from Wall Street toward Apple might come as a surprise. Despite the tech giant experiencing a significant slowdown in sales growth and maintaining a relatively high valuation, with shares trading at a forward earnings multiple of nearly 26, analysts seem bullish.

One reason for this optimism could be the anticipation surrounding Apple’s June developer conference. It is widely speculated that the company will unveil its generative AI strategy during the event, which could serve as a significant catalyst.

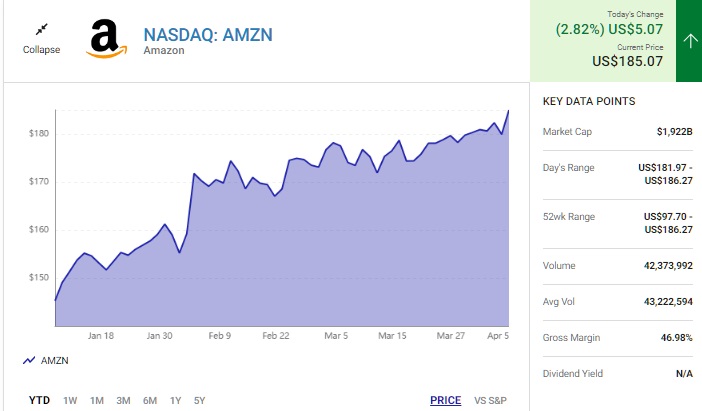

2. Amazon

Amazon (AMZN 2.82%) hasn’t delivered Nvidia’s jaw-dropping returns. However, the e-commerce and cloud services leader nonetheless pleased investors with a gain of 80% last year and a 20% jump so far this year.

According to Wall Street, Amazon’s upward trajectory may not be over yet. The consensus price target for the stock sits approximately 6.5% above its current share price. Among the 47 analysts surveyed by LSEG in April, forty-three rate Amazon as a buy or a strong buy.

The ongoing momentum in Generative AI continues to bolster Amazon Web Services (AWS), as customers prefer to operate applications where their data resides.

Given that AWS holds the leading market share among cloud platforms, many organizations are choosing it for training and deploying their Generative AI applications.

Moreover, Amazon’s advertising arm is experiencing robust growth. Leveraging AI, the company enhances the relevance of ads shown to customers. Additionally, it has expanded its advertising reach on Prime Video.

3. Alphabet

Shares of Google parent Alphabet (GOOG 1.32%) (GOOGL 1.31%) jumped 58% in 2023. The stock is up over 10% year to date in 2024. Like Apple and Amazon, Alphabet still has more room to run in Wall Street’s view.

The average analyst’s 12-month price target suggests a nearly 6% increase from the current price. Wall Street’s sentiment towards the tech stock remains overwhelmingly positive, with 38 out of 43 analysts surveyed by LSEG in April rating Alphabet as a buy or a strong buy.

Despite a couple of setbacks experienced by Alphabet’s Google unit with its generative AI apps, such as Bard last year and more recently, Gemini earlier this year, analysts appear largely unfased.

Their attention is primarily directed towards the growth prospects of Google Cloud and Google’s continued dominance in search. Additionally, some analysts hold high expectations for Alphabet’s Waymo self-driving car business in the long term.

Could Wall Street Be Right?

Relying solely on Wall Street’s price targets can be risky, as even seasoned analysts cannot predict the future with absolute certainty. However, there’s merit in considering their perspectives on certain stocks like Apple, Amazon, Alphabet, and Nvidia.

While Nvidia’s potential for further growth is promising, increased competition poses a risk, making the stock susceptible to volatility.

Positive news from Apple’s developer conference could significantly boost its shares. Both Amazon and Alphabet are expected to experience robust growth in the coming quarters, largely fueled by the momentum of generative AI.

Although Wall Street’s predictions aren’t always accurate, in this instance, I find myself aligning with analysts’ views on these particular Magnificent Seven Tech Stocks.